Description

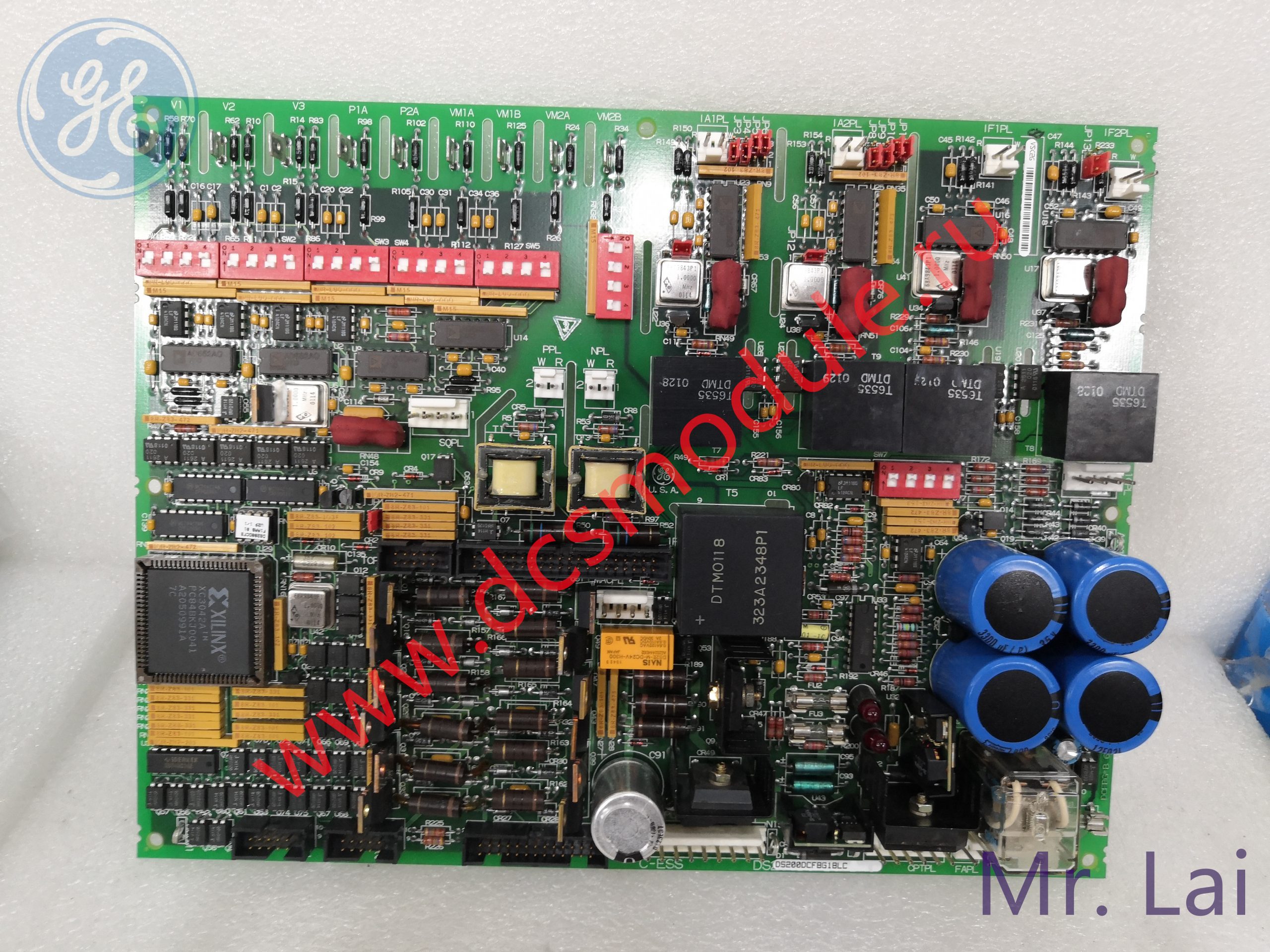

IS220PDIIH1B General Electric Processor Board Mark VI

Analysis of demand for industrial robots in the automotive industry

The automotive industry remains the largest robot application industry globally, with a share of almost 30% of total supply. Investment in new automotive production capacity and

modernization processes have driven the automotive industry”s demand for robots. The use of new materials, the development of energy-saving drive systems, and fierce competition

among major automotive markets are the fundamental driving forces for the extensive use of industrial robots in the automotive industry.

According to OICA statistics, 79% of the installed capacity of industrial robots in the automotive industry is distributed in 5 key markets: China (39,351 units), Japan (17,346 units),

Germany (15,673 units), the United States (15,246 units), and South Korea (11,034 units) .

In 2019, the year-on-year growth in fixed asset investment in my country”s automobile industry was around 0%, and the overall situation was sluggish. This is also the lowest situation in recent years.

It is predicted that with my country”s automobile sales stabilizing in 2020, fixed asset investment is expected to bottom out and rebound, driving the industrial robot industry to pick up.

Breakdown of industrial robot status in 3C industry

3C is the collective name for computer , communication and consumer electronic products, also known as “information appliances”. Such as computers, tablets, mobile phones or digital

audio players. The 3C industry is another important source of demand for industrial robots.

In 2018, the global demand for electronic equipment and components continued to decrease, and the Sino-US trade friction had a direct impact on Asia. Asia is an important production

base for global electronic products and components. The highest installed capacity of robots in the 3C industry reached 122,000 units in 2017. , dropped to 105,000 units in 2018. The

installed robot capacity in the 3C sub-industry mainly comes from three countries: China (43%), South Korea (19%), and Japan (17%).

In addition, 5G from the three major operators will enter commercial application in the second half of 2019. In November 2019, the overall domestic smartphone market shipped 130.47

million units, a year-on-year decrease of 1.3%. However, the growth rate has improved significantly compared with the 10.7% year-on-year decline in August. The innovation brought by 5G to

smartphones will not only increase smartphone shipments, but will also drive upgrading of mobile phone technology (TWS headsets, TOF lenses, etc.), which can drive demand for 3C

automation equipment and thereby increase industrial robot shipments.

According to data from the China Business Industry Research Institute, in 2017, my country”s industrial robot applications in the above fields accounted for 33.30%, 27.7%,

10.8%, 7.9%, and 2.3% respectively, of which the automotive industry and 3C accounted for more than 60%. At present, both automobiles and 3C have bottomed out and are rebounding, with

obvious signs of improvement in demand. It is expected that the industrial robot industry chain will rebound in 2020. In addition to the automobile and 3C industries, the

downstream application fields of industrial robots also include metal processing, plastics and chemicals, food, beverages, tobacco and other industries.

The market demand for industrial robots will continue to expand in the future.

Reviews

There are no reviews yet.