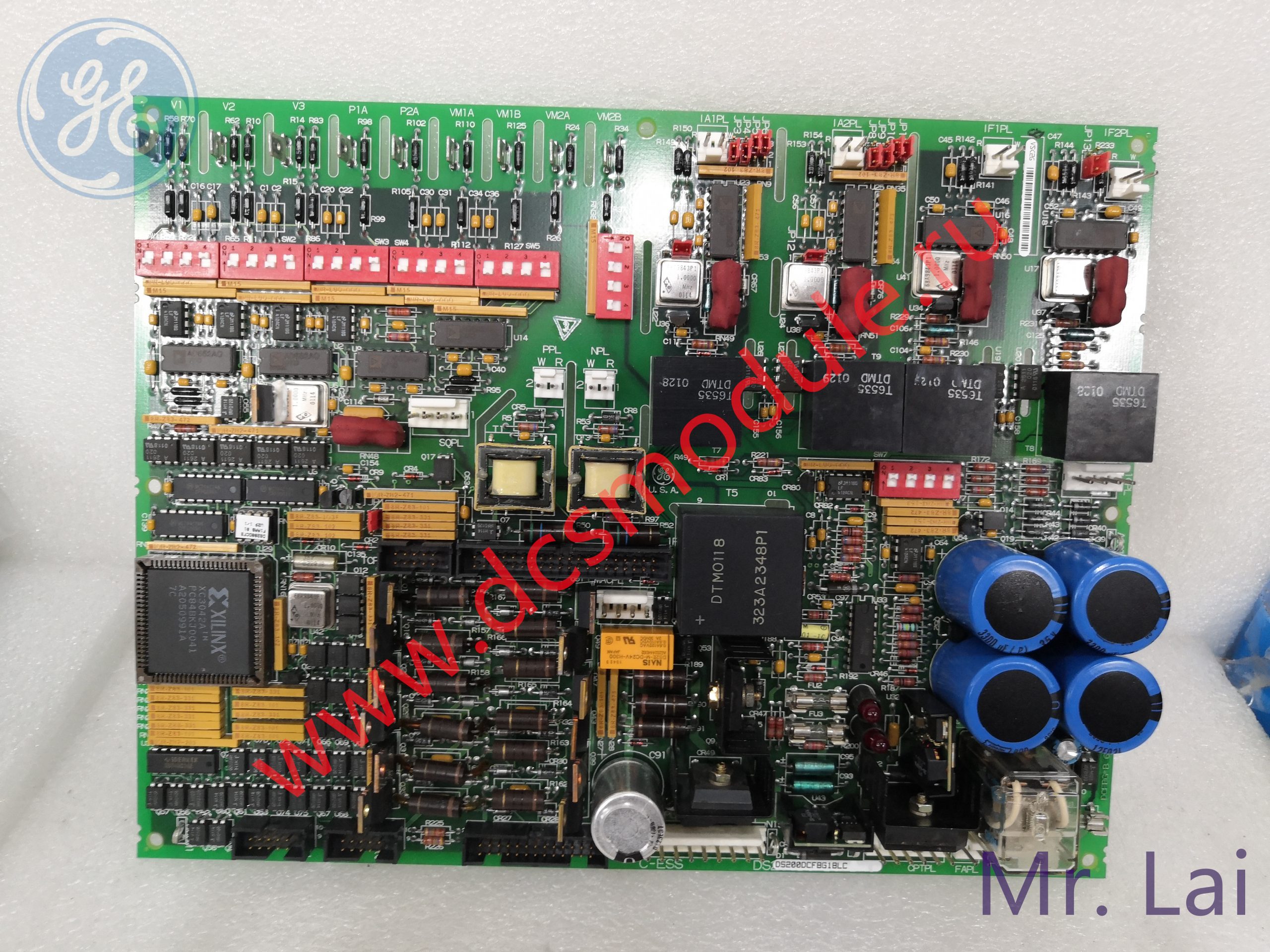

Description

DS200SDCCG4AHD Exciter terminal board

The relevant person in charge of ASD Qianjiang Robot introduced that the “intelligent surfacing work line” consists of

Qianjiang QJRB20-1 handling robot, Qianjiang QJR6-1400 arc welding robot, welding system, L-shaped positioner,

tooling fixture, vision system, welding The management system consists of seven parts. Among

them, the application of the vision system reduces the requirements for feeding and stacking finished products, reduces

manual intervention, and makes the entire work line more automated, and can be applied in many fields.

The innovative point of the automatic grinding and polishing unit for castings is the use of laser displacement sensors

for analysis. During work, the unit can detect the shape of the workpiece, calculate it based on the scan results, and guide

the robot to polish it to ensure polishing consistency. The electric spindle is used with special tool grinding products to improve grinding quality.

Use high-power 20KW flexible adaptive spindle grinding to achieve consistent grinding. Using two parallel circulation

conveying lines, the robot can realize uninterrupted grinding and polishing to improve production efficiency. Equipped with

a tool library to solve the problem of frequent replacement of repair consumables. Cooperate with the MES system to trace

and manage product information

and control product quality.

GE plans to announce spin-off decision to focus on building a “small but lean” company

It is reported that GE plans to announce a spin-off decision as early as this spring, and it is more likely that 20 billion

US dollars of assets will face a spin-off. The hindered development of diversified business segments, weak stock price

performance and adjustments to

the executive team are all considered to be likely to accelerate the spin-off process. The reporter asked GE to confirm

whether it would spin off this spring. As of press time, the company

had not responded.

In the past year of 2017, the U.S. stock market performed brilliantly, but GE underperformed the market

. The stock has fallen 40% over the past 12 months, while the S&P 500 has gained 22.5% during the same period.

GE is already the worst-performing stock in the Dow Jones Index in 2017. In addition, its performance is also lower than that of rival industrial giants such as

Honeywell, ABB, and Siemens. With the continuous layoffs in 2017, GE has become the U.S. company

that has announced the largest number of layoffs.

The reporter combed through and found that, including the 12,000 layoffs in the power generation business announced on

December 7, 2017, the troubled manufacturer had announced 19,242 layoffs last year. Of the latest layoffs, Russell Stokes,

head of GE Power, said: “This is a painful decision but a necessary one; the downturn in the power generation market has led to a decline in products

and services. Sales have dropped significantly and GE Power needs to respond.”

GE”s new CEO, John Flannery, seems to be signaling that he is preparing to make major changes to the company.

Flannery has said that 2018 will be a “reset year.” He emphasized that GE must be transformed into a small and

refined company. After the reorganization, GE will only focus on its three core businesses: power, aviation and medical

equipment, while exiting some smaller businesses. Unlike the relatively stable business strategies of most industrial giants, Flannery”s predecessor Immelt

pursued a more radical strategy. Through capital transfers totaling nearly US$600 billion, he completely transformed GE

into a company with a future An industrial company that embraces the Internet in its prototype form. But now it seems that this

strategy is facing uncertainty as

GE continues to spin off.

According to the transformation plan announced last year, GE will divest at least US$20 billion in assets through

sales, spin-offs, etc. These business segments include Transportation, Industrial Solutions, Electricity and Lighting as

well as several small and medium-sized business segments. The reporter asked GE how this move would affect its business sector in the Chinese

market. As of press time, no response had been received from GE. However, reporters noticed that the R&D center

founded by former global vice president Chen Xiangli has been closed.

In fact, cutting US$20 billion in business means a weight loss of about 17% for an industrial giant with annual

revenue of about US$126 billion. Flannery pointed out that GE will “quite rationally” abandon some businesses

and retain only those divisions with growth, market leadership and large market shares. Prior to this, GE had already

begun to divest related assets. In September 2017,

Swiss industrial giant ABB announced that it would acquire GE”s global industrial solutions business GE Industrial

Solutions for US$2.6 billion, which will be integrated into ABB”s Electrical Products division.

However, Duan Xiaoying, GE”s global senior vice president and president of China, told reporters earlier, ”

During GE”s internal operations, mergers and acquisitions and divestitures are things that GE has to do

every quarter. Therefore, mergers, acquisitions and divestitures are important to GE internally. It’s a normal thing.”

In addition to business spin-offs, reporters noted that on January 16, local time in the United States,

GE Capital, GE’s financial services arm, stated that it had re-evaluated the company’s insurance business

and planned to make a provision of US$6.2 billion in the fourth fiscal quarter.

GE Capital also said in a statement that it expects to contribute approximately $15 billion to the

statutory surplus reserve over the next seven years. It is expected to be $3 billion in the first quarter

of this year and $2 billion each year between 2019 and 2024. To this end, the company will

suspend dividends to the parent company for the foreseeable future. U.S. industry analyst Wendy

ZHU told reporters that this will strengthen the market”s understanding that GE

is facing severe challenges. After the above news came out, GE”s stock price fell more than 4% to $17.96 before the opening of U.S. stocks on Tuesday local time.

Reviews

There are no reviews yet.